Bill of Exchange

The bills of exchange is a document in writing, containing an unconditional order signed by the maker directing a certain person to pay on demand or at a fixed or determinable future time period, the certain sum of money only to or to the order of a certain person or to the bearer of the document.

Bills of Exchange Definition

The bill of exchange is defined as written order for payment issued by the creditor to his debtor is known as bills of exchange.

Features of Bill of Exchange

1. Bills of exchange must be in writing.

2. Bills of exchange are not a request to pay and an order to pay.

3. The order must be signed by the drawer, i.e. the maker.

4. The order must be for the payment of money only.

5. The money payable not vague and must be certain.

6. The bills of exchange must be payable to a certain person mentioned in the instrument or to his order or to the bearer of the document.

7. The order must be unconditional, i.e. no condition should be attached to the order.

8. The order must be directed to a certain person, who must be named or otherwise indicated with reasonable certainty.

Bill of Exchange Advantages

1. The bills of exchange grant the debtors his credit full period. Debtors cannot be asked to pay the amount before the date of due.

2. The bills of exchange facilitate credit sales and credit purchases.

3. The bill of exchange fixes the payment date and this enables the creditor to know when he can expect his money (cash). Debtor also knows when he is

required to make the payment or settlement.

4. The bill of exchange offers an easy way of sending money from one to another place.

5. The bills of exchange are a negotiable document. And so, bill of exchange can be transferred from one person to another person in debts settlement.

Meaning of Promissory Note

The promissory note is an instrument in writing containing an unconditional under taking signed by the maker to pay a certain sum of money only to or to the order of a certain person or to the bearer of the instrument (document).

Bills of Exchange Example

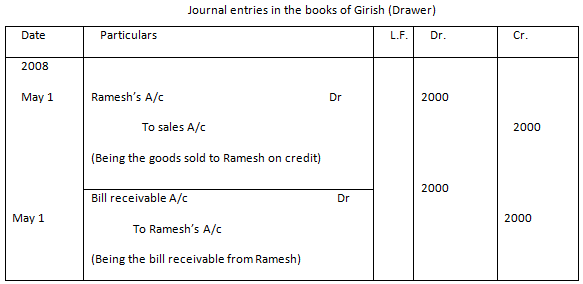

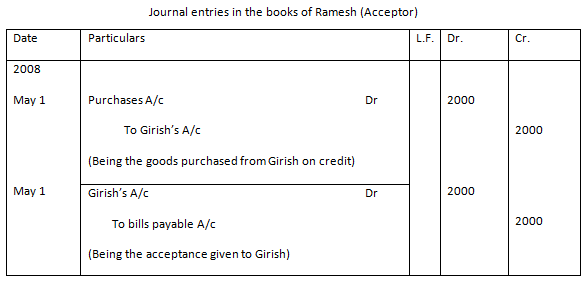

1. On 1st may 2008, Girish sold goods to Ramesh for Rs. 2000 and drew a three months bill on him for the amount. Ramesh accepts it and returns it to Girish. Pass the journal entries in the books of both the parties.

Solution:

In the books of Girish (Drawer)

a. For the sale of goods of the value of Rs. 2000 to Ramesh on credit.

b. For the receiving or drawing of a bill receivable of Rs.2000 from Ramesh.

In the books of Ramesh (Acceptor)

a. For the purchase of goods of the value of Rs. 2000 from Girish on credit.

b. For the giving or issue of a bill payable of Rs. 2000 to Girish.

Average Acceleration Calculator

Average acceleration is the object's change in speed for a specific given time period. ...

When an object falls into the ground due to planet's own gravitational force is known a...

In Mathematics, the permutation can be explained as the arrangement of objects in a particular order. It is an ordered...

A rectangle can be explained as a 4-sided quadrilateral which contains equal opposite sides. In a rectangle

A three sided polygon which has three vertices and three angles is called a triangle. Equilateral triangle...