Double Entry Accounting

The double entry system of book-keeping is the system almost universally practiced in advanced business concern. It's efficient and simple. The double

entry system is scientific and complete system of rules.

All business concern transaction affects the method of accounting elements in at least 2 methods, i.e. Debit and Credit rules and this method of recording transaction is known as Double Entry System of Book Keeping. Since each transaction the common Accounting equation is:

Assets=Liabilities + Owners Equity

What is Double Entry Accounting?

The process of double entry system of book keeping was 1st developed by Luca Pacioli. He was a Franciscan monastic of Italia. On the passing of time and the system has carried out lot of development levels. It's the only process meeting all the targets of orderly accounting system. This system recognizes the 2 fold aspect of all the business concern transactions.

A double entry system of book keeping is the system below which each transaction is affected to have 2 fold aspect and both the prospects are entered to obtain complete register of transaction. The double entry system of book keeping stands by to the principle, and that for each transaction the debit entry amount must equal the credit sum. That's why this system is called double entry system of book keeping.

Advantages of Double Entry System

A double entry principle can be useful once we want to find a fault in financial (fiscal) records. Suppose total debit entry don't equal total credit entry, in this there must be a fault. Still, a double entry system of book keeping system cannot ascertain complete truth. E.g., still suppose debit entry balances equal credit entry ones, a mistake may still be present as a wrong account statement was credited (or debited) once the accounting entry was prepared.

The double entry system of book keeping transactions is entered in conditions of credits and debits. Because a debit in 1 account will be start by a credit

in a different accounting, and the sum of all debit entry must hence be exactly equal to the sum of all credit entry. Double-entry system of book keeping

or accountancy makes it easier to precisely prepare financial statements instantly from the books of detect errors and account.

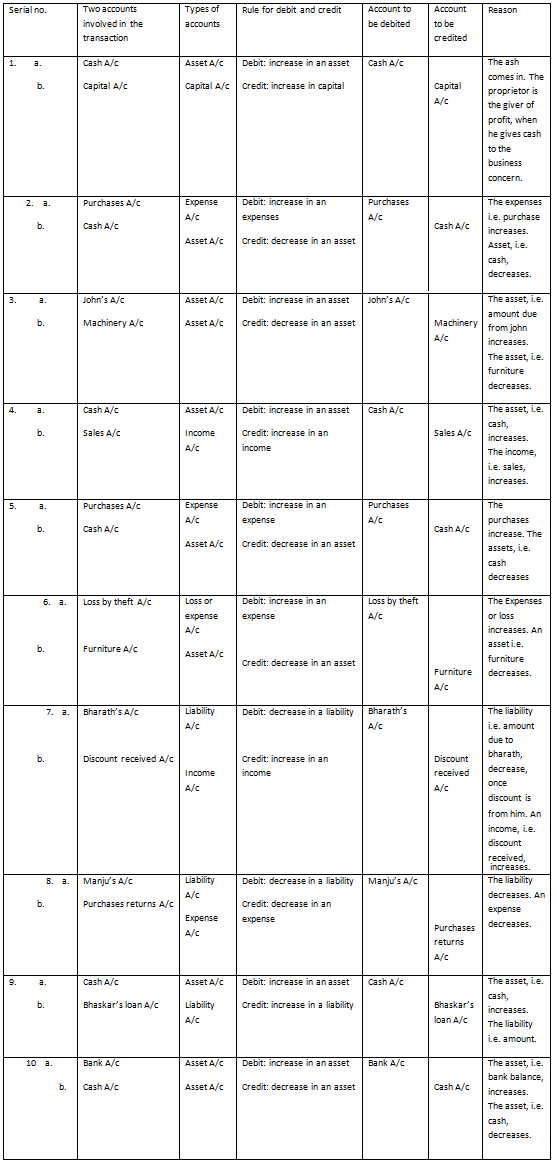

Double Entry System Example

1. Mention with reason which account should be debited and which account should be credited in each of the following transactions according to English approach and American approach.

a. Ramesh commenced the business with Rs. 5000.

b. Purchased goods from manju for cash Rs. 1000.

c. Machinery sold to John on credit Rs. 500.

d. Goods sold for cash Rs. 800.

e. Cash purchases Rs. 600.

f. Office furniture stolen Rs 500.

g. Discount received from bharath Rs. 100.

h. Goods returned to manju Rs. 300.

i. Loan received from Bhasker Rs. 1000.

j. Bank account opened with Rs. 600.

Answer:

Under English approach:

Under American approach:

Average Acceleration Calculator

Average acceleration is the object's change in speed for a specific given time period. ...

When an object falls into the ground due to planet's own gravitational force is known a...

In Mathematics, the permutation can be explained as the arrangement of objects in a particular order. It is an ordered...

A rectangle can be explained as a 4-sided quadrilateral which contains equal opposite sides. In a rectangle

A three sided polygon which has three vertices and three angles is called a triangle. Equilateral triangle...