Final Accounts

A final account is the profit and loss account and balance sheet which is prepared from trial balance expressed from the ledger account. The balance sheet

reflect the position of the company as on the date once profit and loss account gives the result of the business concern that is profit or loss (income or

loss).In the business, there are 2 faces of balance sheet assets and liabilities. Liability side shows company's capital, reserves, loans and creditors and

asset side shows the loans and advances and current and fixed assets.

The word 'final accounts' stands for statements which are finally made to show the loss suffered or profit earned by the business firm and financial situation of the firm at the end of the period involved. So to know the profit or loss earned by a company, trading and profit and loss account or income statement is made. This statement is as well known as 'instruction of functioning's'. Once the financial position is estimated by means of preparing a balance sheet of the business concern. Even this statement is as well known as 'place instruction' or 'instruction of financial status". Later section of the website we shall study the process of preparing these 2 instructions.

Trial Balance

The foundation of these instructions is trial balance account. Trial balance includes all the accounts from the ledger (day book). And the nature of which may be either the personal, normal or real. This should be noted that by the trial balance only nominal accounts are shifted to the profit and loss account (A/c). The personal or real accounts go to the balance sheet account.

Financial Statements

Financial statements of an organization built at the end of an accounting period of time, generally the financial (fiscal) yr.

The final accounts is a some what early book keeping term that relates to the final trial balance at the end of an accounting system period from which the fiscal statements are came. The final trial balance includes the entire journal entries used to close the books of accounts, specified payroll tax and wage accruals, depreciation and amortization, overhead assignation and customer charges. Hence, the final accounts can refer to the financial statements or the final trial balance upon which they are placed. Primary financial statements are the earnings report, statement of cash flows and balance sheet.

Final Accounts Examples

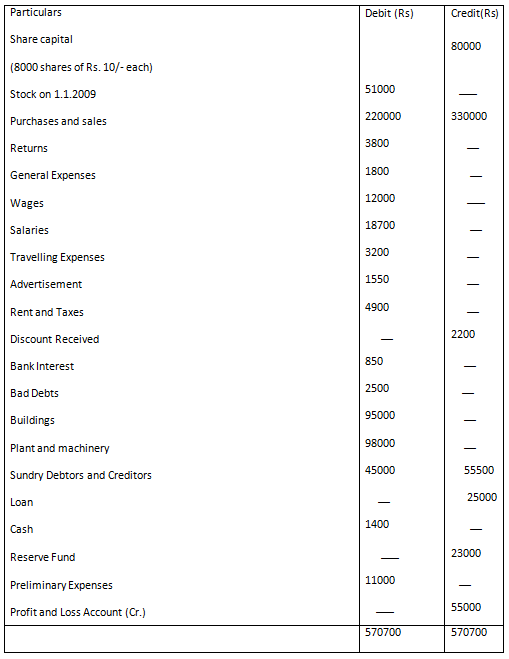

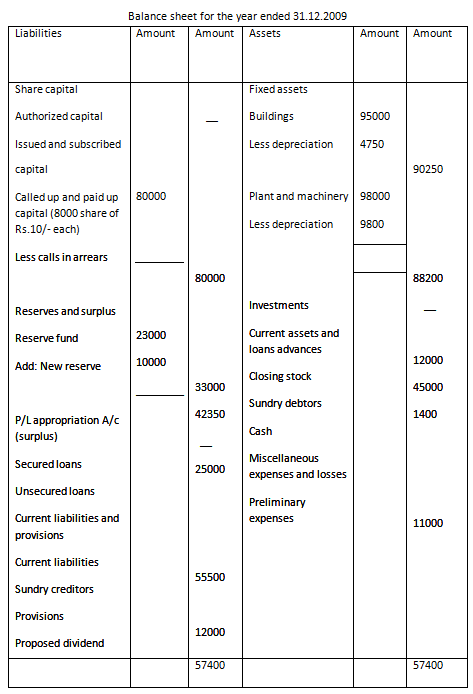

1. Following is the Trial Balance of Sanjai Ltd., Hospet as on 31.12.2009.

Trial Balance as on 31.12.2009

Adjustments:

1. Transfer Rs. 10000 to Reserve Fund.

2. Provide depreciation on building at 5%.

3. Stock on 31.12.2009 was valued at Rs. 12000.

4. Dividend at 15% on share capital is to the provided.

5. Depreciation on Plant and Machinery at 10%.

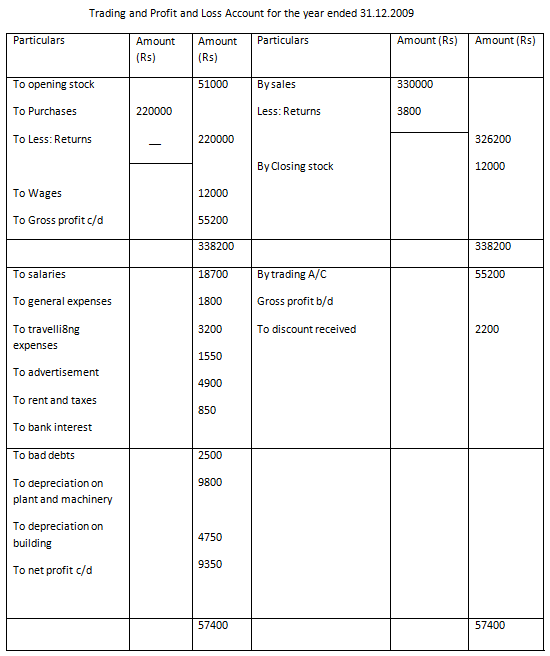

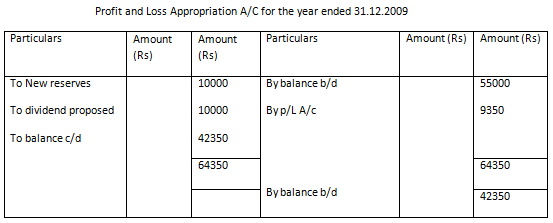

Prepare Trading, profit and Loss account, Profit and Loss Appropriation, Account and Balance Sheet in the prescribed form.

Solution:

Average Acceleration Calculator

Average acceleration is the object's change in speed for a specific given time period. ...

When an object falls into the ground due to planet's own gravitational force is known a...

In Mathematics, the permutation can be explained as the arrangement of objects in a particular order. It is an ordered...

A rectangle can be explained as a 4-sided quadrilateral which contains equal opposite sides. In a rectangle

A three sided polygon which has three vertices and three angles is called a triangle. Equilateral triangle...