Depreciation

The depreciation is defined as an accounting system methodology which allows for an organization to outspread the price of a fixed asset over the required

useful life of that asset in the business. The price of the fixed asset directly comes out of the cash accounting of the organization and is recorded as an

asset for the organizations. And at the end of each period of the valuable life of the asset a part of the price is expensed (losses). The amount is

increased the accumulated the depreciation for the asset of the business concern. This net value of the asset on the report of the organization is the

asset accounting less the collected depreciation account of the firm.

Many assets misplace their value extra time (put differently, they depreciate (devaluate)) and must be replaced when the end of their valuable life is achieved. In this, there are many accounting techniques that are practiced in order to write off an asset's depreciation price over the period of it is useful lifetime. As it's a non-cash expense (loss), the depreciation lowers the company's accounted earnings once increasing free cash flow in the business.

Causes of Depreciation

The depreciation is a non-cash expense that comes down the value of an asset extra time in the environment. The assets depreciate for 2 causes:

1. The tear and wear. E.g., a car will decrease in rate since of the fuel consumption rate, the tires of the wear and other elements related to the use of

the vehicles.

2. The obsolescence. The assets as well decrease in prize as they're replaced by fresher patterns. Most recently year's auto pattern is less valuable since

there is a newer pattern in the market.

The depreciation is an adjustment or planning made in the financial (fiscal) records of a business concern or connection for "technical obsolescence" and "tears and wear" on equipment and plant. The thought of depreciation is to spread the price of that primary asset over the period of it is "valuable life to the entities" that presently owns that. Suppose the full price of the asset were to be carried in the year that it was bought, and so that year's consumption would be unfairly punished once expenditure on the remaining yrs; which were yet receiving the profit from the asset's, wouldn't be forced.

Calculating Depreciation

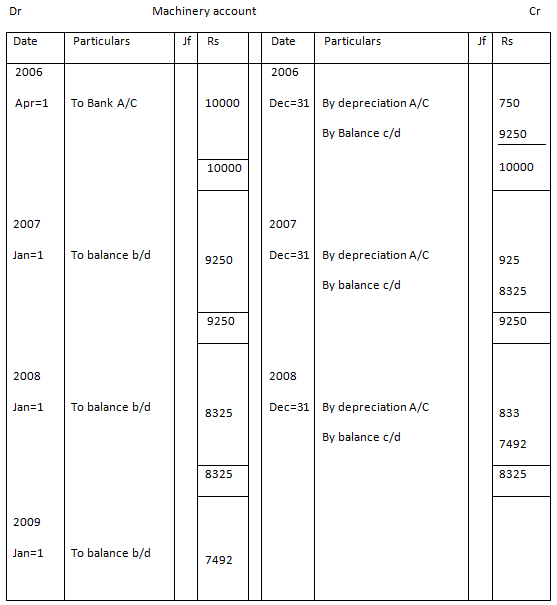

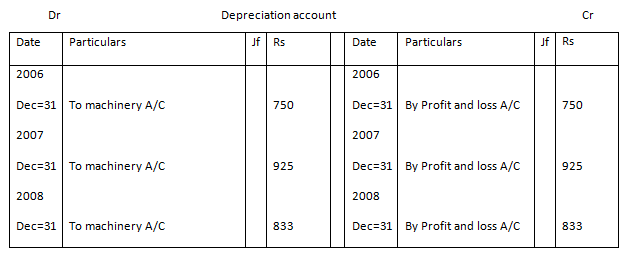

1. A firm purchased machinery for Rs. 10000. On 1.4.2006 depreciation was written off at 10% P.A on diminishing value. The books being closed every year on 31.12.2006. Show the depreciation and machinery account for 3years.

Solution:

Books of __________

Average Acceleration Calculator

Average acceleration is the object's change in speed for a specific given time period. ...

When an object falls into the ground due to planet's own gravitational force is known a...

In Mathematics, the permutation can be explained as the arrangement of objects in a particular order. It is an ordered...

A rectangle can be explained as a 4-sided quadrilateral which contains equal opposite sides. In a rectangle

A three sided polygon which has three vertices and three angles is called a triangle. Equilateral triangle...